Circle introduced a new smart contract function, which allows for near-instant redemptions around the clock for USDC stablecoins from BlackRock’s BUIDL fund.

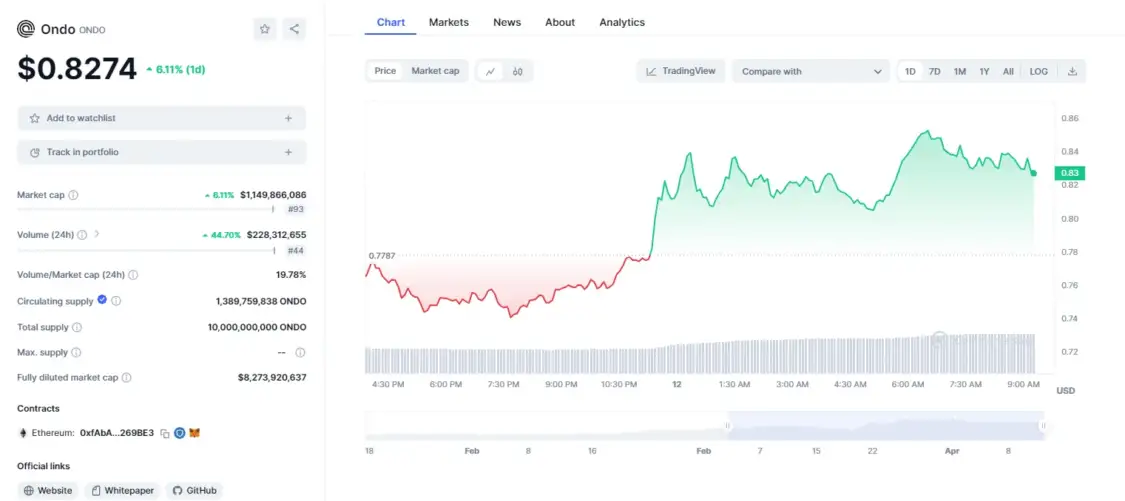

On Thursday, the value of Ondo Finance’s governance token (ONDO) jumped after a new feature was tested, enabling near-instant conversions between Circle’s USDC stablecoin and BlackRock’s BUIDL token. According to Etherscan data, an Ondo wallet on Ethereum exchanged $250,000 worth of BUIDL tokens for USDC.

In an attempt to test the USDC-to-BUIDL feature announced by Circle, Ondo Finance’s wallet on Ethereum redeemed $250,000 worth of BUIDL tokens in exchange for USDC, as per Etherscan data.

What Happened with Ondo Finance Value Today?

According to Allman, “We are using it to power instant 24/7/365 redemptions of OUSG into USDC.” OUSG stands for the Ondo Short-Term U.S. Government Treasuries token, which is secured by securities sold by the U.S. government.

The recent news of transactions started to spread on social media crypto circles, which led to ONDO’s price surging by as much as 8%. However, it has since gone down a bit.

Last month, BlackRock, one of the most influential financial institutions globally, gained attention by entering the asset tokenization race, a popular sector in the crypto industry that transfers traditional financial instruments such as bonds, credit, or commodities to blockchain rails. The BlackRock USD Institutional Digital Liquidity Fund, created in partnership with Securitize, contains cash, U.S. Treasury bills, and repurchase agreements. The Ethereum-based BUIDL token represents an investment in the fund, and token holders receive daily yield paid out via blockchain rails. Ondo Finance was one of the earliest adopters of the fund, using it as a backing asset for its OUSG token.