At some point in our lives, most of us will require financial assistance, whether it’s for purchasing a significant asset like a home or something as small as a sandwich. Even corporations and governments need to borrow money when initiating new ventures. To accomplish this, they may issue bonds, which are small, accessible portions of the loan that investors can purchase in the money markets, providing the necessary capital for the loan. Essentially, bonds allow organizations to borrow money by dividing the loan into smaller ‘bonds’ and making them available to lenders of all types and sizes.

Let’s delve together and understand, is it worth it to invest in bonds for Aussies.

How Do Bonds Work?

Bonds operate similarly to a typical loan. Imagine a mining company requiring money to fund a new project. To secure the necessary funding, the company may issue bonds to investors. In return for the investment, the company guarantees to repay the investors and interest within a predetermined timeframe. For example, you could purchase a 10-year, $10,000 bond with a 3% interest rate. Consequently, the mining company would guarantee to make periodic interest payments on the $10,000, also referred to as coupon payments, and pay back the total principal amount in 10 years. It’s similar to the company writing you an IOU. You can learn more about bonds in our comprehensive guide.

How To Make Money From Bonds?

There are two methods for earning money from bonds. The first involves holding onto them until they mature, allowing you to collect the coupon payments. This means that by the time the bond reaches maturity, you will have received your initial investment and any interest earned during the loan period. Typically, bond interest is paid out semi-annually, although it may also be paid quarterly or annually.

The second method of profiting from bonds involves selling them for a higher price than what you initially paid. For instance, you bought a 10-year, $10,000 bond from a mining company. After a year, the bond price may have risen to $11,000. If you choose to sell the bond at this point, you’ll make a profit of $1,000.

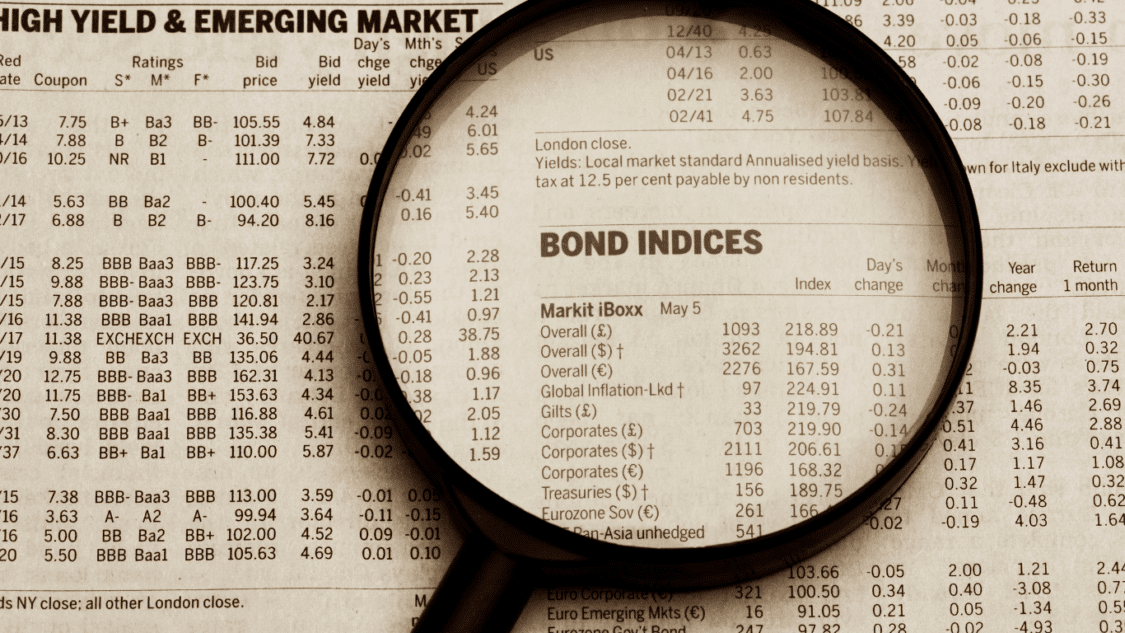

The price of a bond can be influenced by two main factors: interest rates and credit rating. If the interest rate on newly issued bonds is lower than that paid on existing bonds, the existing bonds will become more valuable. For example, if a mining company issues 10-year, $10,000 bonds paying only 2% interest, your bonds paying 3% interest will become relatively more valuable. However, if the company starts issuing bonds with a higher interest rate, like 4%, the value of your bonds will decrease.

The second factor is the credit rating of the issuing company. If the company’s credit rating improves, mainly if it was previously poor, it becomes less risky to invest in its bonds. This leads to an increase in the bond’s price. Conversely, if the credit rating declines, the bond becomes riskier, and the price decreases. Experienced bond traders take advantage of these price fluctuations by buying and selling bonds in bond markets.

Investing in Bonds ETFs

For the average retail investor, buying individual bonds can be expensive. Fortunately, bond funds provide a solution. By pooling contributions from multiple investors, these funds can purchase various bonds, which is ideal for anyone seeking broad exposure to the bond market but needing more significant investment funds. Several exchange-traded funds (ETFs) listed on the ASX offer exposure to domestic and international bond markets. Best of all, these ETFs can be bought and sold just like regular shares.

What Types of Bonds Are There?

In Australia, there are two main types of bonds: corporate and Australian government. Companies issue corporate bonds and typically offer higher interest rates. Still, there is a greater risk of default with small, growing companies than larger, established companies and government entities. On the other hand, Australian Government bonds are issued by the federal government and are usually considered safer investments as there is no default risk. However, they offer lower interest rates compared to corporate bonds.

How To Buy Bonds

If you are looking to invest in bonds in Australia, a few options are available. Typically, wholesale bond purchases require the assistance of a broker (for a fee), as most bonds are not publicly traded and are instead sold ‘over the counter’. It’s worth noting that wholesale bond purchases may require a minimum investment of $500,000, which may only be suitable for some investors.

For those who don’t have the capital for wholesale bond purchases, exchange-traded Australian Government bonds may be a good alternative. These bonds trade on the ASX and work similarly to passive ETFs to mirror a specific bond’s returns. For example, you could invest in 3% interest-paying Australian Government bonds that mature in March 2047 by purchasing units in the Australian Government Treasury Bond.

There are also exchange-traded corporate bonds (XTBs) available for S&P/ASX 200 Index (companies, such as Westpac Banking Corp and Commonwealth Bank. However, it’s worth noting that XTBs are still relatively new products in Australia, and the range of Aussie bonds available to invest in is limited.

Benefits of Investing in Bonds

Income: Bonds’ coupon payments can offer a consistent and reliable income flow.

Diversification: Investing in bonds can bring diversification to your portfolio, which is their most significant benefit. While shares have outperformed bonds over the long term, owning a portion of your bond portfolio can help lower financial risk.

Less volatility: Investing in bonds can be safer than investing in shares, as bond prices tend to experience less volatility.

Cons of Investing in Bonds

Interest rate: Bonds can be risky due to their long maturities. Interest rates may increase before your bond matures, causing a decrease in its value and potentially causing you to miss out on higher interest rates elsewhere if you choose to hold onto it. This is something to consider when making investment decisions.

Long-term commitment: Investing in bonds often requires a long-term commitment, with many maturing at five, 10, or even 20 years from now. This means you’ll need to be prepared to keep your money invested for an extended period.

Issuer default: Although it is not very probable, there is still a chance that the bond issuer may fail to repay their debts, which could jeopardise your interest payments and the return of your principal.

Smaller returns: Investors typically receive a lower return on investment from bonds than riskier financial assets like stocks.

Lack of transparency: Retail investors often find bond markets more obscure than equities markets. This is because they usually require a third party, such as a broker, to conduct trades on their behalf. As a result, there needs to be more assurance that the price paid or received for bonds is reasonable.

Are Bonds a Good Investment in 2023?

Ultimately, it is up to you to answer that question. However, here are some scenarios that may aid you in your decision-making process:

- Buying bonds can be a wise move if you have a significant amount of money invested in stocks. This will add diversity to your portfolio and safeguard you from any unexpected fluctuations in the market.

- Investing in bonds could be a good option for those who are risk-averse and want to minimize the possibility of losing money. Bond prices are usually more stable than stocks, making them a safer investment. However, it’s important to note that the potential return on investment with bonds is also lower.

- If you are in the process of retiring or have already retired, you may want a more reliable source of income to maintain your lifestyle. You can adjust your portfolio to include more bonds than stocks.

How Should You Invest $1,000 Right Now?

So if you’re still wondering is it worth it to invest in bonds for Aussies, If you’re considering investing $1000 today and want to minimize your risk, assigning it to bonds may be a suitable choice for you. However, it’s important to keep in mind the potential drawback of low returns. For most Aussie investors, it’s generally worth allocating a part of your portfolio invested in bonds, but the specific amount will depend on your individual goals and risk tolerance.

Conclusion: Is it Worth it to Invest in Bonds for Aussies

Determining whether is it worth it to invest in bonds for Aussies in 2023 is a complex decision that only you can really answer according to your goals and needs. Bonds represent small portions of loans issued by different entities, providing investors with a way to earn returns through interest payments and potential price appreciation. While bonds offer portfolio stability and diversification, it’s important to consider their limitations, including lower returns compared to riskier assets like stocks, potential issuer default, and the impact of changing interest rates. As with any investment decision, individual circumstances are crucial.

If you tend to take a more cautious approach to investing, especially if you’re approaching retirement or looking for a reliable source of income, it may be advantageous to dedicate a portion of your investment portfolio to bonds. It’s important to make an informed decision based on your financial objectives and risk tolerance when deciding if bonds are a viable investment option in today’s economic climate.