We may look at Bitcoin’s price history in three distinct ways. The pros and cons of both are present, but together they deliver a better picture. Bitcoin’s price history has been rough, with incredible highs and crushing lows throughout the years. Understanding the factors that affect the price of Bitcoin is essential for traders and investors looking to benefit from its price movements.

There are three distinct ways of analyzing Bitcoin’s price history, each with its specific approach. Technical analysis looks at historical price and volume data to identify patterns and trends. Fundamental analysis focuses on external and internal factors to establish an asset’s actual value. The sentimental analysis uses market sentiment, referring to the attitude and feelings of an investor towards a specific asset, to predict price movements. In this article, we will analyze these three analysis methods in greater detail, providing insights into the factors that influence the prices history and how to make informed investment decisions.

- Technical Analysis (TA): Technical analysis is a trading technique using charts and technical indicators to analyze price and volume data to spot patterns and trends. Technical analysis focuses on the historical price and volume data to predict future market behaviour. Technical analysts believe that price movements in financial markets are not entirely random and that by studying past market data, they can identify patterns that will help them predict future price movements. Technical analysis can be used to identify various points, such as support and resistance levels, trends, chart patterns, and momentum indicators, among others.

- Fundamental Analysis (FA): Fundamental analysis evaluates an asset’s intrinsic value by the economic and financial factors that affect it. Such as a company’s financial health, earnings, revenues, assets, liabilities, and management team to determine its actual value. In the case of cryptocurrencies, the fundamental analysis would involve factors like adoption rates, regulatory environment, use cases, competition, and technological innovations. Fundamental analysts believe market prices of any asset eventually reflect its actual value. Therefore identifying undervalued or overvalued assets can help them make informed investment decisions.

- Sentimental Analysis (SA): Sentimental analysis is a technique for predicting market movements. This is done by analyzing the attitudes and feelings of investors towards a specific asset. The sentimental analysis involves tracking news articles, social media, and other sources of information to gauge investor sentiment towards a particular asset. Positive sentiment can drive prices up, while negative sentiment can push prices down. Sentimental, technical and fundamental analysis can help traders and investors make informed decisions.

Which factors influence Bitcoin trading now?

- Bitcoin Regulation: As cryptocurrencies, including Bitcoin, gain popularity, governments and financial institutions worldwide focus on regulating them. Any changes done regarding regulation can significantly impact Bitcoin’s price and trading volumes. When China banned Bitcoin exchanges in 2017, it caused the price of Bitcoin to fall significantly. On the other hand, when countries like El Salvador and Ukraine made Bitcoin legal tender, it increased demand and price.

- Global Economy: Bitcoin has become a popular investment choice during times of economic crisis. Like gold, Bitcoin is viewed as a safe haven asset that can retain its value even with market volatility. Bitcoin’s second name is”digital gold”, as it shares some of the characteristics of gold. When other parts of the economy are not fluctuating, investors may buy Bitcoin to protect themselves against inflation or economic uncertainty.

- Adoption by Large Corporations: Many well-known corporations have increasingly invested in and accepted Bitcoin as payment. Some of the many are PayPal, Square, Visa, and Mastercard, which all support cryptocurrencies. The collaboration of these companies with crypto has significantly increased investor confidence and driven up demand. Additionally, the $1.5 billion Tesla investment in Bitcoin was a significant turning point for the cryptocurrency. This showed investors and the crypto community that even large corporations take Bitcoin seriously as an investment opportunity.

- Speculation and Derivatives: Introducing derivatives such as Bitcoin futures has also affected the cryptocurrency’s price. Future contracts also allow investors to speculate on the future price of Bitcoin, which in turn can drive up demand and increase its value. However, futures contracts can also put downward pressure on the price if investors decide to short Bitcoin for profit. As a result, the value of Bitcoin is no longer solely determined by its utility but also by investor sentiment and market demand.

- Supply and Demand: Supply and demand: The supply and demand of Bitcoin also play a crucial role in its trading. If there is a limited supply of Bitcoin, its price may increase, and vice versa. Additionally, if there is a significant demand for Bitcoin, it could lead to a price increase.

- Media Talk: Bitcoin’s positive or negative media range can also impact its trading. For instance, if Bitcoin is being covered positively by mainstream media outlets, more people may be driven to invest in it, leading to a price increase or vice versa. If the media speaks about the negative aspects of bitcoin trading and the potential risks of various assets, there will be investors who prefer to stay out or take a break from investing as a result.

- Technological advancements: Technological advancements and innovations in cryptocurrency can also impact Bitcoin trading. For instance, developing new blockchain technologies or improvements in security features could lead to more investors joining the market.

What’s the difference between the price history of Bitcoin and Ethereum?

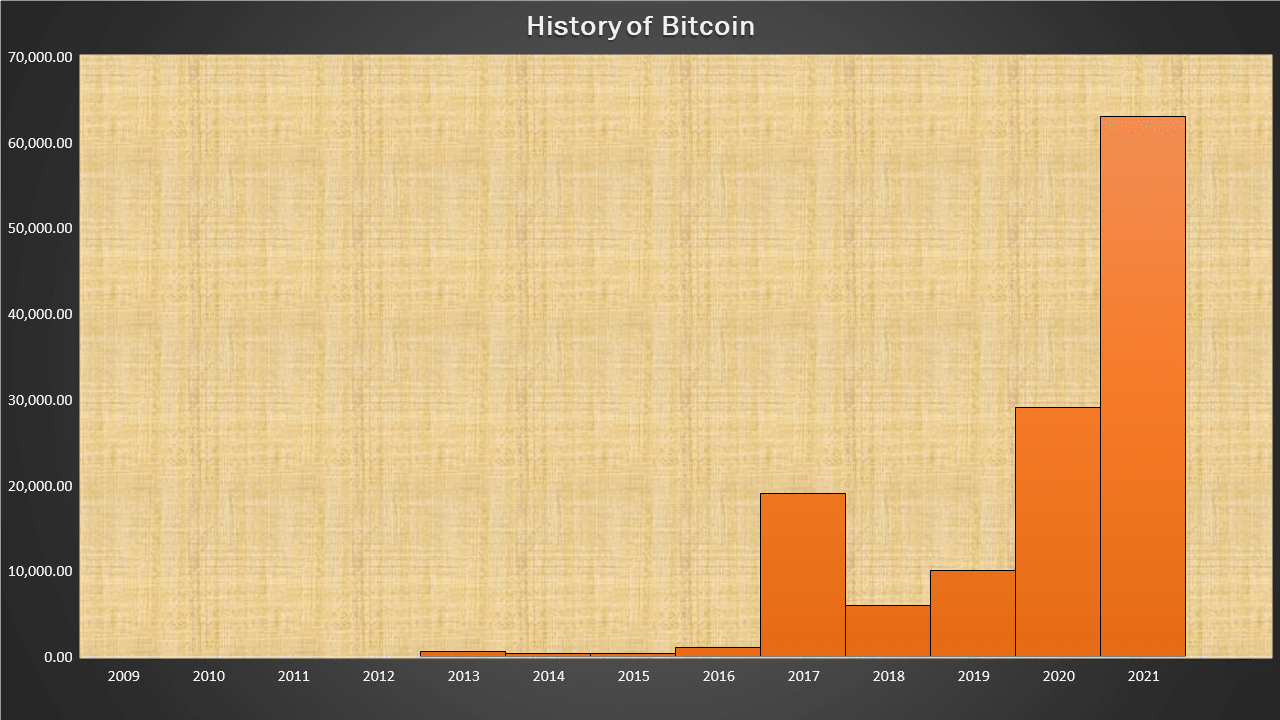

When Bitcoin was introduced, it was worth only a few cents. However, its price increased over the years, reaching a high of close to $65,000 in April 2021. This significant price increase was mainly due to investors’ and businesses’ interest and adoption of Bitcoin. In addition, there was the issue of limited supply and growing demand.

In contrast, Ethereum had a slower start. Its price was $2 when it was first introduced. However, it quickly gained popularity due to its smart contract capabilities and potential for building decentralized applications. By the end of 2015, Ethereum’s price rose to $1, and it continued to grow steadily over the years, reaching over $4,000 in May 2021.

While Bitcoin and Ethereum experienced significant price increases throughout the years, their trajectories and growth reasons differed. Bitcoin’s price rise was affected mainly by its status as the first and most well-known cryptocurrency asset and its limited supply and growing adoption by businesses and investors. Ethereum’s price rise was driven mainly by its smart contract capabilities and potential to build DApps, attracting developers and businesses looking to build on its platform.

In terms of price history, Bitcoin and Ethereum have both experienced significant growth over the years, but for different reasons. However, their impact on the cryptocurrency market and the broader financial world cannot be overstated. They continue to drive innovation and change in how we think about money and value. Despite their price differences, Bitcoin and Ethereum have proven to be valuable investments for many people. Their continued growth and popularity have cemented their place as major players in the cryptocurrency market. Their impact on the broader financial world will only continue to grow in the years to come.

Closing thoughts:

There are various ways people have that explain Bitcoin’s price history. However, over the years, no matter which explanation we look at, there has been a drastic rise in digital currencies. Even looking within cryptocurrencies, bitcoin shows a market value of just under 50 % as of August 2021, and its market capitalization stands at $710,000,000,000.

This exponential growth has to do with its fundamentals, market feeling, and economic events. The performance that we see in the past doesn’t necessarily let us predict its future. It helps us understand why Bitcoin had such a high price, but we can’t say where it will stand in the coming months or years. Though Bitcoin has been around for roughly 12 years, it has grown pretty well for its age.

In conclusion, understanding Bitcoin’s price history requires the use of different analytical tools, including technical, fundamental, and sentimental analysis. Technical analysis involves the use of charts and historical data to predict future price movements. In contrast, the fundamental analysis examines the underlying economic and financial factors affecting an asset’s value. The sentimental analysis considers the attitudes and feelings of investors towards Bitcoin, which can also impact its price.

By using these different analytical methods together, investors can understand Bitcoin’s price history and make informed investment decisions. However, it’s important to remember that the cryptocurrency market is highly volatile and unpredictable, and there is always a risk of losing money. Therefore, it’s essential to do thorough research and consult with financial professionals before investing in Bitcoin or any other cryptocurrency.

As the cryptocurrency market continues to evolve, so will the tools and methods used to analyze it. Investors can maximise their chances of success in this exciting and dynamic market by keeping up-to-date with the latest developments and staying informed about regulatory changes and market trends.