- Types of accurate Forex Signals (technical analysis, fundamental analysis, machine learning algorithms, etc.)

- How to choose the Forex signals provider for you?

- The benefits of having the best Forex signals in trading:

- How to use Forex signals in a trading strategy?

- The importance of accuracy in Forex signals:

How To Choose The Best Forex Signals ? Hard question but good that you asked.

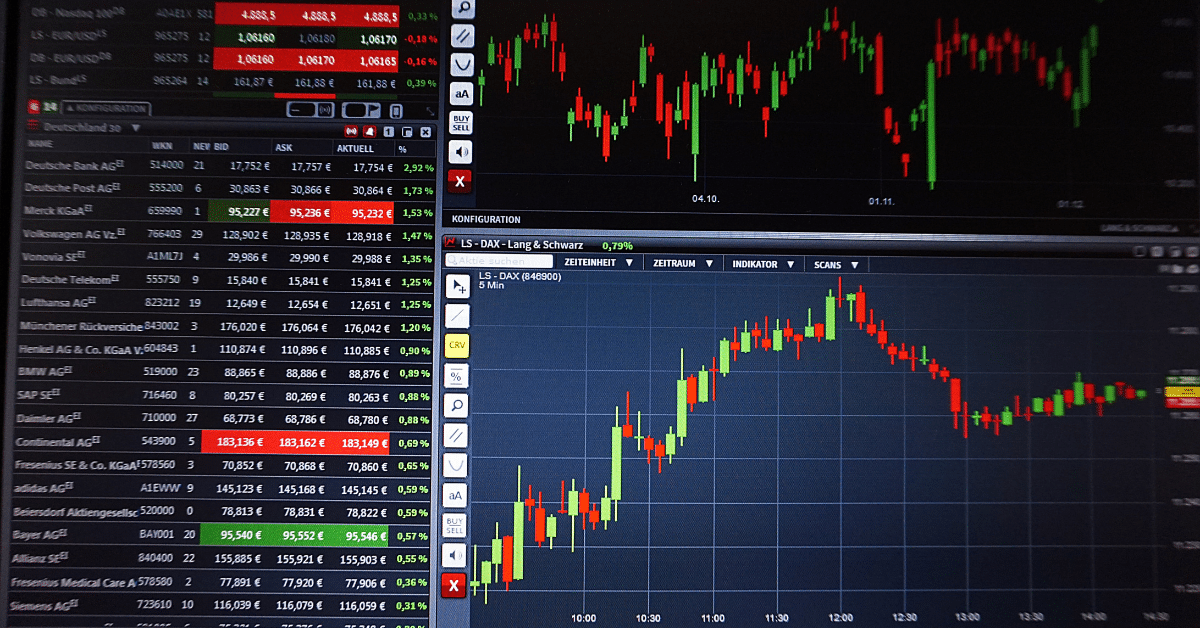

The foreign exchange market, also known as the forex market, is the largest financial market in the world, boasting a daily trading volume of over $5 trillion. To succeed in this dynamic and highly competitive market, traders need to have a deep understanding of the key elements driving currency prices and have a solid strategy in place. This is where accurate forex signals can come in handy, providing traders with valuable insights into market trends and helping them make smart decisions about buying and selling currencies.

In this article, we will explore the benefits of using accurate forex signals, including:

- Understanding Forex signals and how they work

- Types of Forex signals (technical analysis, fundamental analysis, machine learning algorithms, etc.)

- How to choose a reliable Forex signals provider.

- The benefits of using Forex signals in trading.

- How to use Forex signals in a trading strategy.

- The importance of accuracy in Forex signals.

- The role of Forex signals in risk management.

- Free vs Paid Forex Signals: Which One is Right for You?

- The limitations of Forex signals and the importance of using them as a supplement to your own analysis.

- Real-life case studies and examples of successful Forex signal usage.

- Tips for maximizing the potential of Forex signals in your trading.

There are several vital elements that traders should consider when choosing accurate forex signals. These elements include the type of analysis used to generate the signs, the movements’ reliability, and the signals’ cost.

Type of Analysis: Forex signals can be generated using a variety of methods, including technical analysis, fundamental analysis, and machine learning algorithms. Technical analysis involves using charts and other technical indicators to identify trends and patterns in the market. Fundamental analysis consists of using economic data and news events to predict future market movements. Machine learning algorithms use data and statistical models to predict the market.

Reliability: The reliability of forex signals is critical for traders. As it determines the success of their trades. To assess the reliability of a forex signal provider, traders should consider the provider’s track record and the accuracy of the signals provided. They should also consider the provider’s customer support and the transparency of their trading performance.

Cost: Forex signals can be free or paid, with paid signals generally more reliable and comprehensive. Free calls may be less reliable and provide less information than paid signals. Traders should consider their budget and the value they receive from the signals when choosing a forex signal provider.

Types of accurate Forex Signals (technical analysis, fundamental analysis, machine learning algorithms, etc.)

Forex signals are indicators or suggestions for entering or exiting a trade in the foreign exchange (forex) market. Technical analysis, fundamental analysis, machine learning algorithms, or a combination of these methods generate them. Traders use them to make informed decisions about their trades.

- Technical Analysis Forex Signals: These signals are generated by analyzing price and volume data in the market to identify trends and patterns. Technical analysis uses charting tools and technical indicators to figure the strength and direction of a currency’s trend.

- Fundamental Analysis Forex Signals: These signals are generated by analyzing economic and political factors that affect the supply and demand of a currency. Fundamental analysis considers factors such as interest rates, inflation, and political stability to determine the strength and direction of a currency’s trend.

- Machine Learning Algorithm Forex Signals: These signals are generated by computer algorithms that use machine learning to analyze market data and make predictions. AI(artificial intellegency) algorithms can process large amounts of data and identify patterns and relationships that are not easily visible for the untrained eye.

- Hybrid Forex Signals: These signals are generated by combining technical analysis, fundamental analysis, and machine learning algorithms. Mixed signals can provide a more comprehensive view of the market and increase the accuracy of trading decisions.

How to choose the Forex signals provider for you?

Forex signals can be a beneficial tool for traders in the foreign exchange market, but choosing a reliable provider is critical to maximizing their benefits. Here are some tips for selecting a reliable Forex signals provider:

- Research the provider: Before subscribing to a Forex signals provider, it is essential to research their background and track record. Look for online reviews, testimonials, and case studies to understand their performance and accuracy level better.

- Check the provider’s results: Most Forex signals offer historical performance data. Reviewing this information and comparing it to your trading results is essential. This will give you a good presentation of the provider’s level of accuracy and reliability.

- Consider the provider’s methodology: Forex signals providers use different methodologies to generate signals, including technical analysis, fundamental analysis, and machine learning algorithms. It is essential to understand the provider’s approach and determine if it aligns with your own trading style and goals.

- Look for transparency: A reliable Forex signals provider should be transparent about their methodology, results, and limitations. They should also be open about their fees and any potential risks of using their signals.

- Consider the provider’s customer support: Good customer support is essential. Especially if you are new to Forex trading. Choose a provider that offers responsive and knowledgeable customer support to help you get the most out of their signals.

- Free vs. paid signals: While free Forex signals can be a good way to get started, paid signals often offer more comprehensive and reliable information. However, it is essential to remember that no Forex signals provider can guarantee 100% accuracy.

The benefits of having the best Forex signals in trading:

Understanding the benefits of using forex signals is essential for making informed decisions about your trading strategies. The main benefits of using forex signals in trading:

- Time-saving: Forex signals can save traders a significant amount of time by reducing the need for extensive market analysis. Forex signals can provide traders with quick and accurate market insights. Allowing them to focus on other aspects of their trading strategy.

- Increased profits: Forex signals enable traders to decide when to buy and sell currencies. Resulting in increased profits and reduced losses. Accurate forex signals provide traders with the necessary information to enter and exit trades at the optimal time. Which leads to maximized profits.

- Reduced stress: Forex signals can help reduce the stress of making trading decision. This opens time for traders to focus on other aspects of their lives. With forex signals, traders can confidently make trades, knowing that they have received expert advice on the best time to enter and exit the market.

- Portfolio diversification: Forex signals can also help traders to diversify their portfolios, reducing their overall risk. Traders can gain access to a wider range of trading opportunities, reducing their exposure to market volatility.

- Improved accuracy: Forex signals can also help to improve the accuracy of trading decisions. With reliable forex signals, traders can receive valuable market insights and make informed decisions about their trades. Reducing the risk of making costly mistakes.

How to use Forex signals in a trading strategy?

To effectively use forex signals in your trading strategy, you must understand how they work and how to choose a reliable forex signals provider.

To begin with essential to understand that forex signals are simply suggestions or recommendations for entering or exiting a trade. They are generated using technical analysis, fundamental analysis, or machine learning algorithms. They are designed to provide traders with information about the direction in which a currency is likely to move. While forex signals can be helpful. They should never be the sole basis for your trading decisions. It’s important to use your analysis and judgment when making trades.

Once you understand the basics of forex signals, you can start researching potential forex signals providers. Opting for a reliable provider, it is important to consider their signals’ accuracy and their track record of providing profitable trades. You can also read reviews and testimonials from other traders to understand the provider’s reputation.

Once you’ve chosen a reliable forex signals provider. You can start incorporating their signals into your trading strategy. Forex signals can be useful for identifying potential buying or selling opportunities and determining when to enter and exit trades. They can also help you save time and reduce the stress of trading decisions.

In addition to using forex signals to identify buying and selling opportunities, you can also use them to diversify your portfolio and reduce your overall risk. By following various signals from different providers, you can better understand the market and make informed decisions about your trades.

The importance of accuracy in Forex signals:

The accuracy of Forex signals is crucial to the success of a Forex trading strategy. Forex signals are used to inform traders about the direction in which a currency is likely to move, allowing traders to make informed decisions about when to buy and sell. However, if the Forex signals are inaccurate. Traders may make incorrect trades and lose money.

One of the main reasons for the importance of accuracy in Forex signals is that the Forex market is constantly changing. Market conditions can change quickly. If the Forex signals are not up to date-or accurate, traders may miss important opportunities or make trades based on outdated information.

Another reason for the importance of accuracy in Forex signals is that they are often used as part of a larger trading strategy. For example, some traders may use Forex signals to identify potential entry and exit points for trades. While others may use them as part of a larger risk management strategy. If the Forex signals are not accurate, these larger strategies may not be effective, and traders may end up losing money.

To ensure that Forex signals are accurate, traders should choose a reliable Forex signals provider. This choice can be made by researching different providers, reading reviews and testimonials from other traders, and comparing their track records. It is also important to consider the methods used by the provider to generate Forex signals, such as technical analysis, fundamental analysis, or machine learning algorithms.

In conclusion, the accuracy of Forex signals is essential to the success of a Forex trading strategy. By choosing a reliable Forex signals provider and considering the methods used to generate the signals, traders can increase their chances of making informed and profitable trades in the dynamic Forex market.

The role of Forex signals in risk management:

Forex signals play a crucial role in managing risk in the foreign exchange market. Forex traders, whether beginners or experienced, face the challenge of making informed decisions in a fast-paced and highly dynamic market. To minimize risk and maximize profits, traders need to understand market trends and conditions. Forex signals provide traders with valuable information about the market’s direction and help them make informed decisions about when to buy and sell.

Forex signals can help traders to manage risk in several ways. Firstly, by providing traders with information about market trends and conditions. Forex signals can help traders to identify potential buying or selling opportunities. This information can be used to give education to trades and reduce the risk of making unprofitable decisions.

Secondly, forex signals can help traders to diversify their portfolios. By using forex signals, traders can enter and exit trades at the right time. Maximizing their profits and minimizing losses. This can help to reduce overall risk and increase the likelihood of making profitable trades.

Thirdly, forex signals can help traders to manage their emotions. Trading can be a stressful and emotional experience, especially for beginners. By relying on forex signals, traders can take emotions out of the equation and make trades based on market trends and conditions rather than their own emotions.

Finally, forex signals can help traders to implement a solid trading strategy. A well-planned trading strategy is essential for success in the forex market. By using forex signals, traders can implement a strategy that considers market conditions and trends. Helping them make informed decisions and achieve their financial goals. Forex signals are crucial in managing risk in the foreign exchange market. By providing traders with valuable information about the market’s direction.

Differences between free and paid Forex signals:

You can get signals through paid or free services. Paid forex signals are provided by professional forex traders or trading companies. They charge a fee for their services. On the other hand, free forex signals are widely available online and can be obtained from various sources such as websites, forums, and social media.

The main difference between free and paid forex signals is the level of accuracy and reliability. Paid forex signals are generally considered to be more accurate as the providers have access to more resources and information to generate signals. However, this does not mean that all paid forex signals are accurate, as the success of a forex signal ultimately depends on the skill and expertise of the provider.

Automated systems or amateur traders usually generate free forex signals, and the accuracy of these signals can vary greatly. Some free forex signals may be accurate and provide valuable information. While others may not be reliable and could lead to losses. Therefore, choosing a forex signal provider with guidance is important, regardless of whether you are using a paid or free service.

Ultimately, the choice between paid and free forex signals depends on the individual trader’s needs and preferences. Paid forex signals are more reliable. However, they also come at a cost. On the other hand, free forex signals can be a useful tool for traders just starting out or for those looking to test a new trading strategy. Regardless of the type of forex signal. It is important to research and choose a reliable provider with a proven track record of accuracy.

The limitations of Forex signals and the importance of using them as a supplement to your own analysis.

There are many benefits to using Forex signals in trading, including saving time and reducing stress, increasing profits, and improving risk management. Forex signals can help traders enter and exit trades at the right time, maximizing their profits and minimizing losses. Forex signals can also help traders diversify their portfolios and reduce their overall risk.

Forex signals can be part of a comprehensive trading strategy alongside your own analysis and judgment. For example, traders may use Forex signals to confirm their own analysis or to generate new trade ideas. However, it is vital to remember that Forex signals are simply suggestions and should not be relied upon exclusively.

Accuracy is critical in Forex signals, as inaccurate signals can lead to poor trading decisions and significant losses. Traders should research different providers and compare their track records before choosing a Forex signals provider.

Forex signals can also play an important role in risk management. By providing information about the market’s direction, Forex signals can help traders make informed decisions about when to enter and exit trades, reducing the risk of losses. However, traders must still use their judgment and analysis when making trading decisions and must not rely solely on Forex signals.

Real-life case studies and examples of successful Forex signal usage.

It is important to understand that Forex signals are not a guarantee of success and should be used in conjunction with your own analysis and judgment.

One successful case study of Forex signal usage is the story of a beginner trader who struggled to succeed in the highly competitive forex market. The trader began using Forex signals provided by a reputable provider and soon noticed a significant improvement in their trading performance. The signals allowed the trader to enter and exit trades at the right time, maximizing their profits and minimizing losses.

Another example is a seasoned trader who had become complacent in their approach to the forex market. Despite years of experience, the trader was no longer seeing the success they had once enjoyed. They decided to try using Forex signals and were impressed by the results. The signals gave the trader a fresh perspective on the market and allowed them to identify new trading opportunities they had previously overlooked.

Here we will give a few examples of the many success stories of Forex signal usage in the forex market. While Forex signals cannot guarantee success, they can provide traders with valuable information and insights that can help them to make informed decisions and increase their chances of success. No matter if you are at the begging or an experienced trader, Forex signals can play an important role in your trading strategy and help you achieve your foreign exchange goals.

Maximizing the potential of Forex signals in your trading can be achieved by following these tips:

- Combining signals with your own analysis: While Forex signals can provide valuable information, it’s important to use them in conjunction with your own analysis. This will help you to confirm the signals and make more informed trading decisions.

- Sticking to a strategy: When using Forex signals, having a well-defined strategy is important. These signals will help you to stay focused and avoid making impulsive decisions.

- Monitoring performance: Regularly monitoring the performance of your Forex signals provider will help you to assess their accuracy and determine if they are helping you to achieve your trading goals.

- Diversifying your portfolio: Diversifying your portfolio by using accurate Forex signals from multiple providers can help to reduce your overall risk and increase your chances of success.

- Keeping up with market trends: Keeping up with market trends and staying informed about economic events can help you to make more informed decisions and improve your overall performance when using Forex signals.

- Staying disciplined: It’s important to stay disciplined and stick to your trading plan when using Forex signals. This will help you to avoid making impulsive decisions and to maximize your potential for success.

With these tips, you can maximize the potential of accurate forex signals in your trading and increase your chances of success.