Introduction

In the world of online brokerage, SydneyFX stands out as a reliable and comprehensive platform for discerning traders. Whether you are a seasoned professional or a beginner, SydneyFX offers precision and a wide range of account types to cater to diverse trading objectives. In this review, we will explore SydneyFX’s key features, services, and benefits, providing you with the necessary information to make an informed decision.

Ready to trade with confidence? Click here to sign up with SydneyFx

Table of Contents

SydneyFX Pros and Cons

Before delving into the details, let’s take a look at the pros and cons of SydneyFX:

Pros

- User-Friendly Platforms: SydneyFX offers intuitive and cutting-edge trading platforms suitable for traders of all levels.

- Competitive Spreads: The broker provides competitive spreads, ensuring traders can maximize their profits.

- Wide Asset Range: SydneyFX offers access to a diverse array of assets, providing ample trading opportunities.

- No Commission Fees: Traders can benefit from fee-free trading, as SydneyFX does not charge commissions on standard accounts.

- Regulatory Compliance: The broker works according to regulatory guideline standards, ensuring a secure and trustworthy trading environment.

Cons

- Limited Educational Resources: SydneyFX falls short in providing comprehensive educational materials.

- Leverage Risk: While leverage can amplify profits, it also poses a risk of significant losses, requiring traders to exercise caution.

Now that we have an overview of the pros and cons, let’s dive deeper into SydneyFX and explore its key features, regulatory compliance, trading instruments, account types, fees, and trading platforms.

Ready to trade with confidence? Click here to sign up with SydneyFx

Regulatory Compliance and Safety

When it comes to online trading, safety and trust are of utmost importance. SydneyFX prioritizes these aspects, ensuring a secure trading environment for its clients.

Regulation: SydneyFX operates according to the regulation guidelines of reputable regulatory bodies, including the ASIC (Australian Securities and Investments Commission), the FCA (The Financial Conduct Authority) and the CySEC (Cyprus Securities and Exchange Commission). These regulatory bodies enforce strict standards, ensuring transparency and fairness in the broker’s operations.

Fraud Prevention: SydneyFX implements state-of-the-art security measures, including robust encryption protocols and stringent identity verification procedures. These measures safeguard clients’ personal information and prevent unauthorized access.

Client Fund Security: SydneyFX segregates client funds from operational funds to protect against financial instability. This separation ensures that clients’ funds are protected, even in the unlikely event of financial instability within the company.

Trading Instruments

SydneyFX offers a diverse range of investment instruments, providing traders with ample opportunities to explore various markets. Let’s take a look at the key trading instruments available on the platform:

Forex Trading

At SydneyFX, forex trading is a flagship feature, with over 60 currency pairs available for both novice and experienced traders.

Commodities

SydneyFX provides traders access to a wide range of commodities, including precious metals like gold, silver and platinum, crude oil, natural gas, and agricultural commodities. This enables traders to explore multiple commodity markets.

Cryptocurrencies

To cater to the growing interest in cryptocurrencies, SydneyFX offers trading options for popular digital assets like Bitcoin, Ethereum, and Ripple (XRP). Cryptocurrency market is known for its volatility and potential returns, which makes it an attractive option for traders to invest in.

Indices

SydneyFX grants access to a variety of global indices, enabling traders to speculate on the performance of major stock indices from around the world. This allows for diversification and exposure to different markets.

Stocks, Futures, Bonds, and Options

While SydneyFX primarily focuses on the forex and CFD markets, it does not provide trading options for traditional futures contracts, bonds, or options. However, for Australian residents, SydneyFX offers the option to purchase real shares and stocks, exclusively for Australian clients.

Ready to trade with confidence? Click here to sign up with SydneyFx

Account Types

SydneyFX offers a range of account types to cater to the diverse needs of traders. Let’s explore the main account types available on the platform:

Live Accounts

SydneyFX offers three primary account types: the commissions-free Standard Account, the commissions-based Raw Spread Account, and the cTrader Raw Spread Account. These options provide traders with flexibility, allowing them to choose an account that aligns with their specific trading needs. The Raw Spread Account is particularly suitable for professionals seeking ultra-tight spreads and faster execution.

Demo Account

SydneyFX provides a demo account, allowing traders to practice and refine their strategies with virtual funds in a risk-free environment. This invaluable resource is especially beneficial for newcomers looking to gain confidence before venturing into live trading.

Islamic Account

SydneyFX offers Islamic accounts, making it accessible for traders adhering to Islamic principles. These accounts comply with Sharia law, ensuring that trading activities are in line with Islamic finance principles.

Commission and Fees

SydneyFX adopts a competitive and transparent fee structure, designed to cater to traders with varying needs. Here’s an overview of the fees charged by the broker:

Trading Fees

Standard Accounts operate on a spread-only model, meaning that trading fees are included in the spreads. In contrast, Raw Spread Accounts incur commissions per lot traded. The specific commissions can vary depending on the asset and account currency.

CFD Fees (Spreads)

SydneyFX offers competitive spreads for CFD trading, ensuring cost-effective access to a wide range of asset classes.

Account Fee

SydneyFX does not impose account maintenance fees, promoting cost transparency.

Inactivity Fee

The broker does not charge fees for inactive accounts.

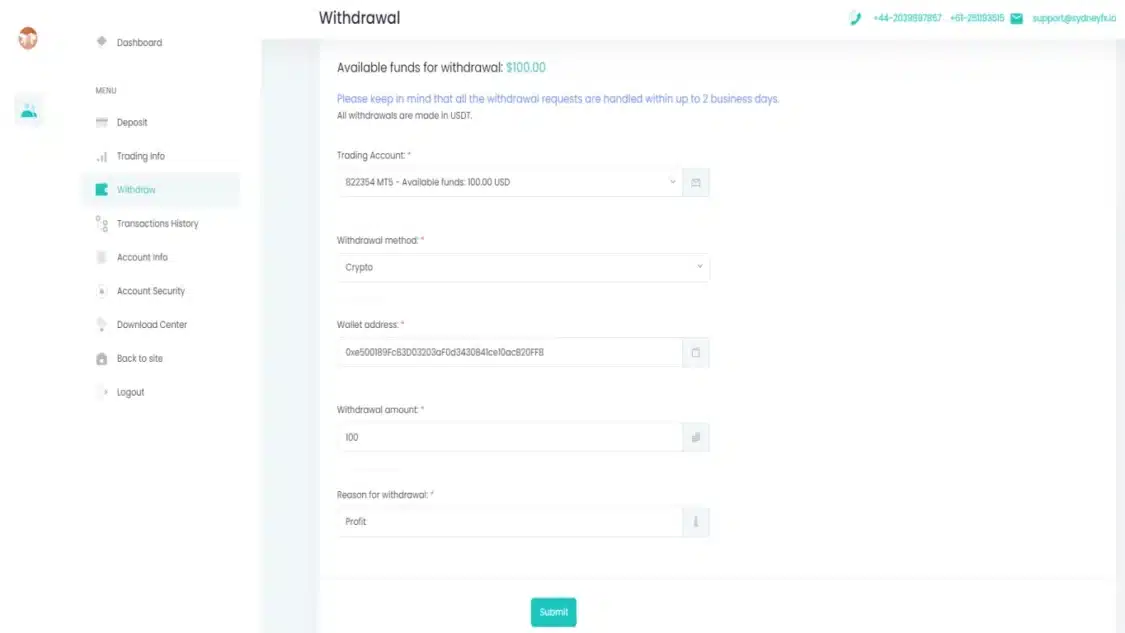

Deposit and Withdrawal Fee

SydneyFX does not charge fees for deposits or withdrawals, making it convenient for traders to fund their accounts and access their funds.

Overnight Financing Fee

Traders holding positions overnight may be subject to financing fees, which can vary based on the asset and position size.

Currency Conversion Fee

Traders using different base currencies may incur currency conversion fees for deposits and withdrawals.

Trading Platforms

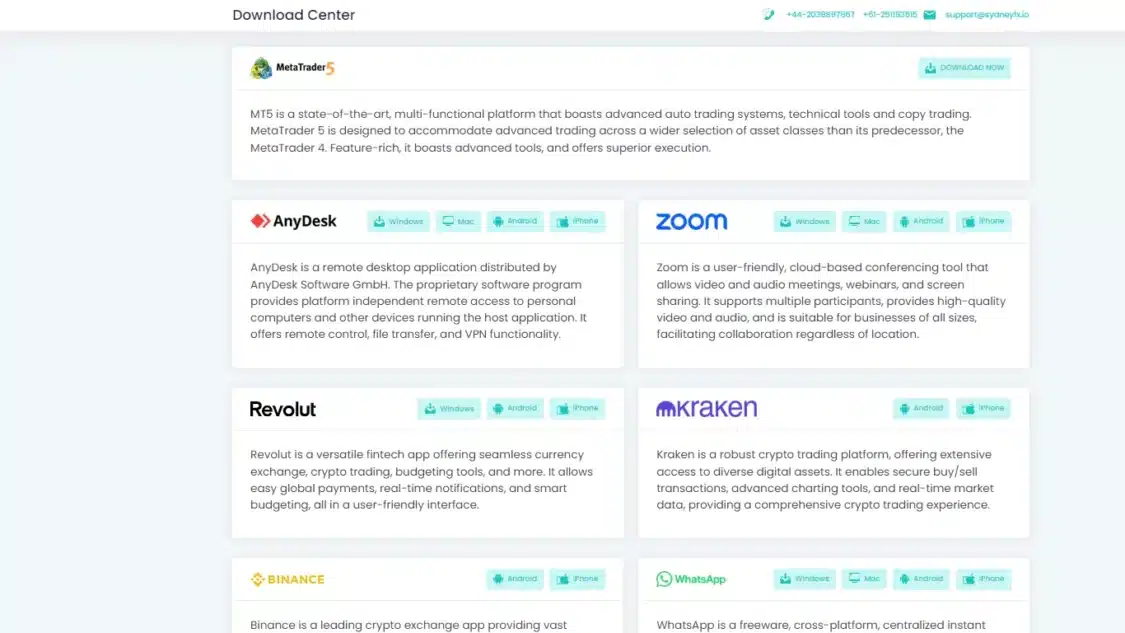

SydneyFX provides traders with a range of versatile trading platforms, ensuring accessibility and functionality for traders of all levels. Let’s explore the key trading platforms offered by the broker:

MetaTrader 5 (MT5)

SydneyFX supports the MetaTrader 5 (MT5) platform. MT5 offers enhanced features, including additional timeframes and asset classes, providing traders with more options and flexibility.

Mobile Trading Apps

SydneyFX has mobile apps for trading on Android and iOS devices. The apps provide access to real-time market data and allow users to manage positions and execute trades on the go.

Web Trading Platform

SydneyFX offers a web-based trading platform accessible through web browsers without the need for software downloads or installations. This platform provides traders with a seamless trading experience and access to essential trading tools.

Customer Support and Accessibility

SydneyFX strives to provide excellent customer support, ensuring that traders have access to assistance when needed. The platform offers live chat support and other accessible channels like WhatsApp, catering to a global clientele. Traders can reach out to the support team for any queries or concerns they may have. The availability of customer service during weekends further highlights SydneyFX’s commitment to providing comprehensive support to its users.

SydneyFX FAQ

Is SydneyFX Legit?

Yes, SydneyFX operates according to the regulation guidelines of reputable regulatory bodies, including the ASIC (Australian Securities and Investments Commission), the FCA (The Financial Conduct Authority) and the CySEC (Cyprus Securities and Exchange Commission).

Which Educational Resources Does SydneyFX Offer?

SydneyFX offers educational resources and one-on-one trading sessions with their account managers.

Which Trading Platforms Does SydneyFX Offer?

SydneyFX offers two trading platforms: MetaTrader 5 (MT5) and their own Webtrader.

Is There a Commission Fee That I Need to Pay When I Trade With SydneyFX?

SydneyFX offers transparent and competitive fees to suit various traders’ needs.

How is the accessibility of the customer support services offered by SydneyFX?

The platform offers a variety of accessible channels, including live chat support and WhatsApp, which are available to traders across the globe. Whether traders have a query or a concern, the support team is always available to help.

Does SydneyFX offer an Islamic Account?

SydneyFX offers Islamic accounts that comply with Sharia law, making it accessible for traders adhering to Islamic finance principles.

Conclusion

In conclusion, SydneyFX stands out as a reliable and comprehensive online brokerage platform. With its user-friendly interface, competitive spreads, diverse range of trading instruments, and adherence to strict regulatory standards, SydneyFX provides a secure and trustworthy trading environment. Although educational resources are limited, the broker’s commitment to safety and client fund security instills confidence in traders. Whether you’re new or experienced, SydneyFX provides the tools to navigate online trading.

Ready to trade with confidence? Click here to sign up with SydneyFx